If your organization is a school or other type of organization that offers scholarships, then this resource will be helpful to explain the process of accomplishing this in Aplos. There may be different use cases depending on how your organization handles the recording of scholarships, but this will provide a basic overview that you can change to fit your specific needs and processes.

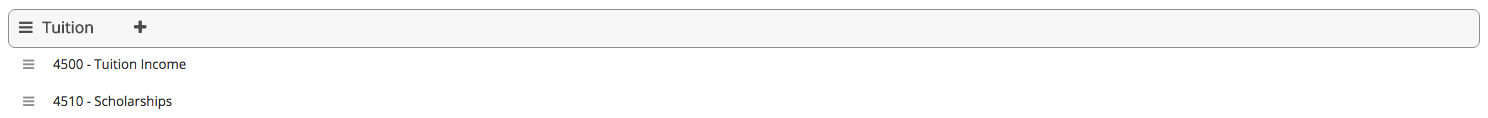

Accounts for Recording Tuition and Scholarships

We recommend that you create a contra income account to track the scholarships that you’ve granted to students. This account will hold a debit balance as opposed to a credit balance in a typical income account. The Aplos Accounts Receivable module has the flexibility to record a negative amount to account for a scholarship, so you’ll use that contra income account to split out what was given to the student as a scholarship. You can even group the income account that you use to record tuition payments and your contra income account for scholarships that you’ve given to students within your Chart of Accounts. Then, on reports, if you choose the option to sub-total by group, this will net the two income accounts.

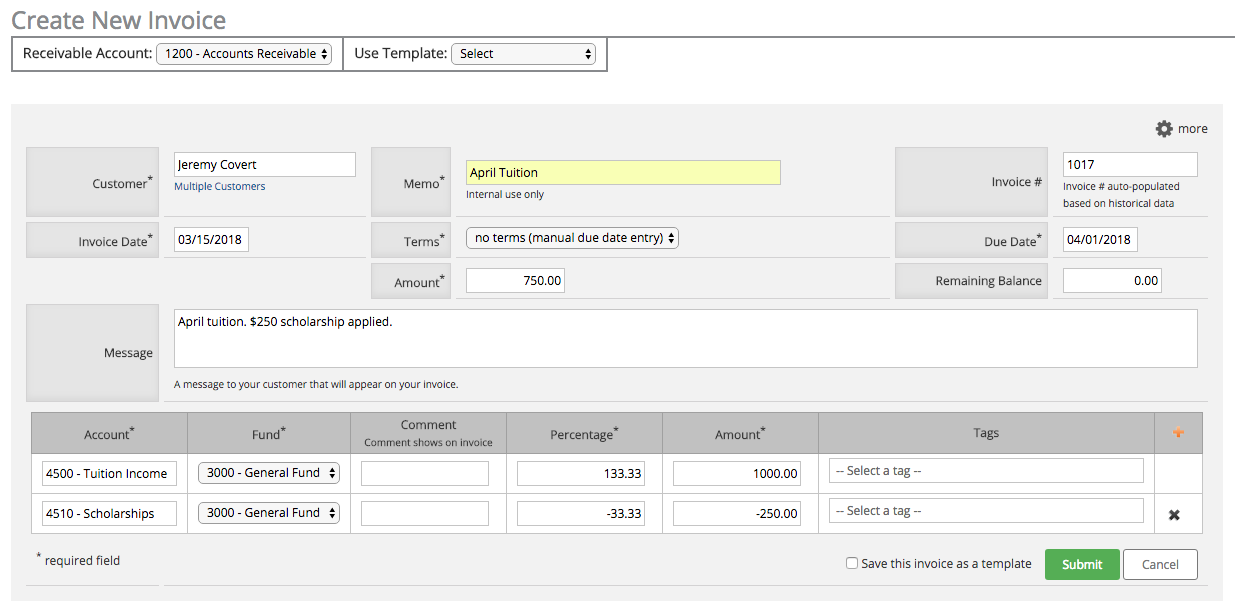

Recording a Discount on an Invoice

Lets say you have a student who owes $1000 in tuition, but you are giving them a $250 scholarship, so they owe $750. You will create a receivable for that student for $750 and will split that receivable to record the full $1000 as Tuition Income, then -$250 as a scholarship. This will bring the net amount of the receivable to $750.

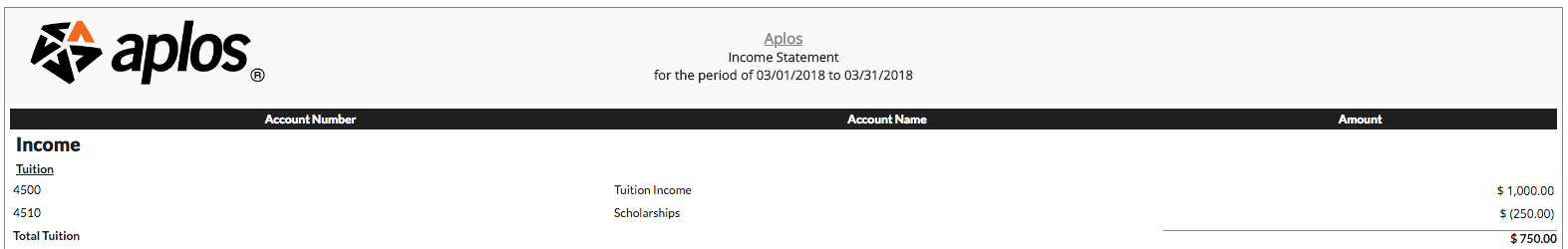

Tuition and Scholarships on Reports

If you’ve grouped your tuition income account and your scholarship income account within your Chart of Accounts, then when you look at your Income Statement, you will see the full amount of $1000 on your tuition income account, and the debit amount of -$250 for the scholarship. The report will subtotal the two and show your net income of $750.

Again, this is a broad example of the process and your organization may do things differently in terms of accounts. An organization might not receive grants or donations for scholarships, so they might want to count that as an expense to the organization. In this case, you’d record the tuition in the same process, but replace the Scholarship in come account with your expense account. There may be other unique scenarios for your organization, so if you need assistance with recording those, please feel free to reach out to our Customer Success team with any questions!