To generate the financial reports you need to manage your organization, first you need to accurately track your income and expenses. There are four primary entry screens available to enter transactions, including the check register, journal entry, contributions management, accounts payable and accounts receivable.

Entering Transactions From Your Register

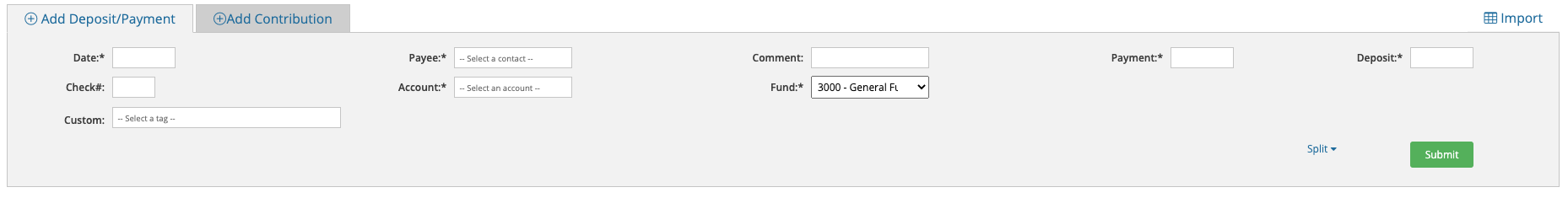

For most organizations, this is where you will spend most of your time. These are transactions that will have an effect on your bank balances. When entering a transaction in the register, required fields include the date, payee, payment/deposit, account, and fund. If you are using Aplos Advanced Accounting, and have enabled your 990 tags, this becomes a required field as well.

From your register, you will also see a graph of fund balances. This will be the balance of your funds within that register’s balance only.

For more information about entering transactions in your register, refer to our resource for Using the Account Register to Track Income and Expense.

Entering Journal Entries

Recording a Journal Entry is the most raw form of entering a transaction. This is your standard double-entry accounting screen. You may not use this screen much if you primarily record your transactions in the register. If you do post a Journal Entry, you will need to be sure that your transaction is balanced. If you see any amount that is out of balance, whether between your debits and credits, or funds, then the Journal Entry will not post.

A second use for the Journal Entry page is to post a Fund Transfer. Get additional details on fund transfers.

For additional details on Journal Entries, check out the following tutorial.

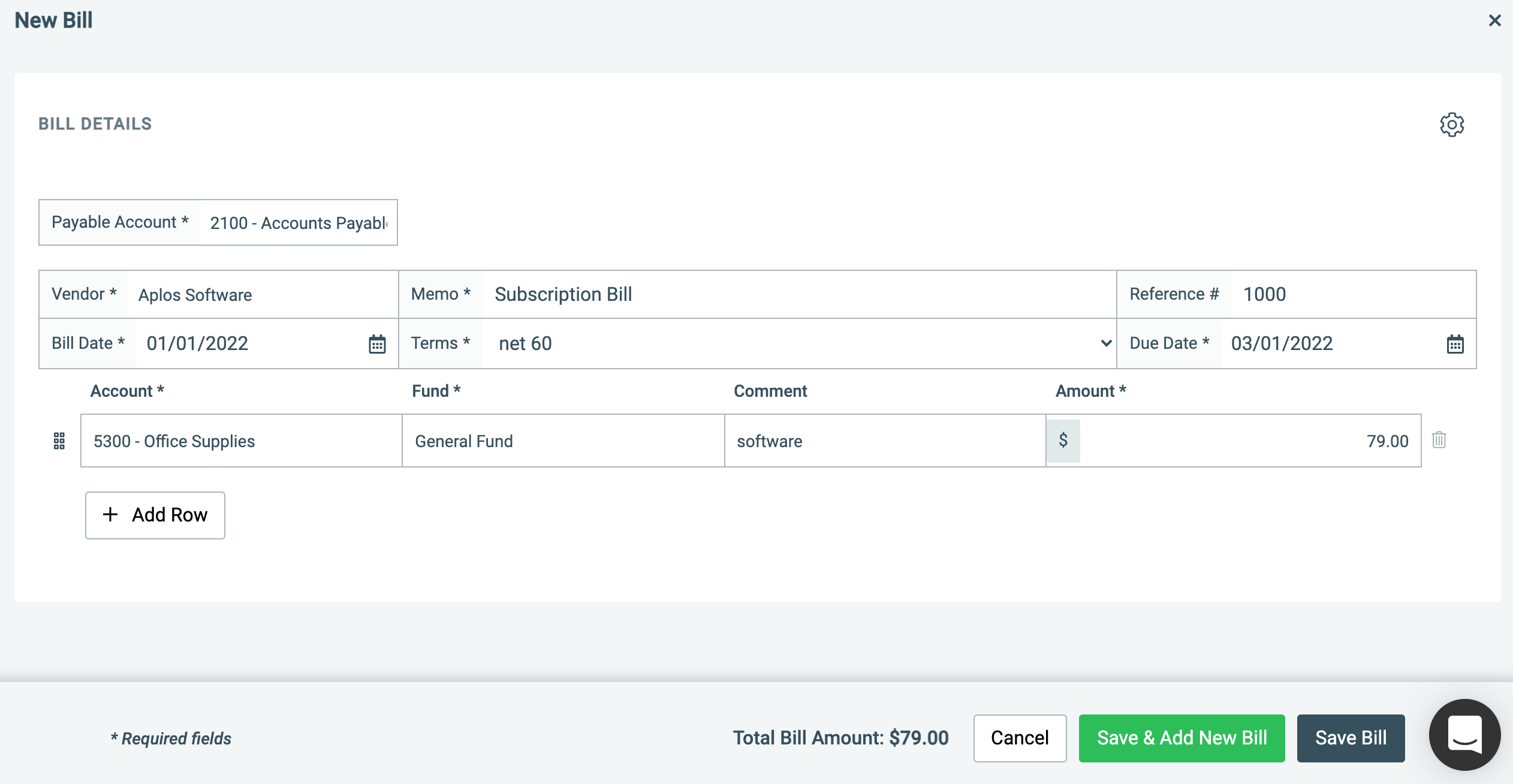

Entering Accounts Payable

Accounts Payable is used to enter transactions that are amounts that you owe but haven’t paid yet. As an example, say you have a contractor come out to make a repair on your property. He gives you an invoice that is due in 30 days. You can record this invoice as a payable. It will reflect an unpaid balance until you send payment to your contractor when it is due.

For more information about entering accounts payable, refer to our resource on Accounts Payable.

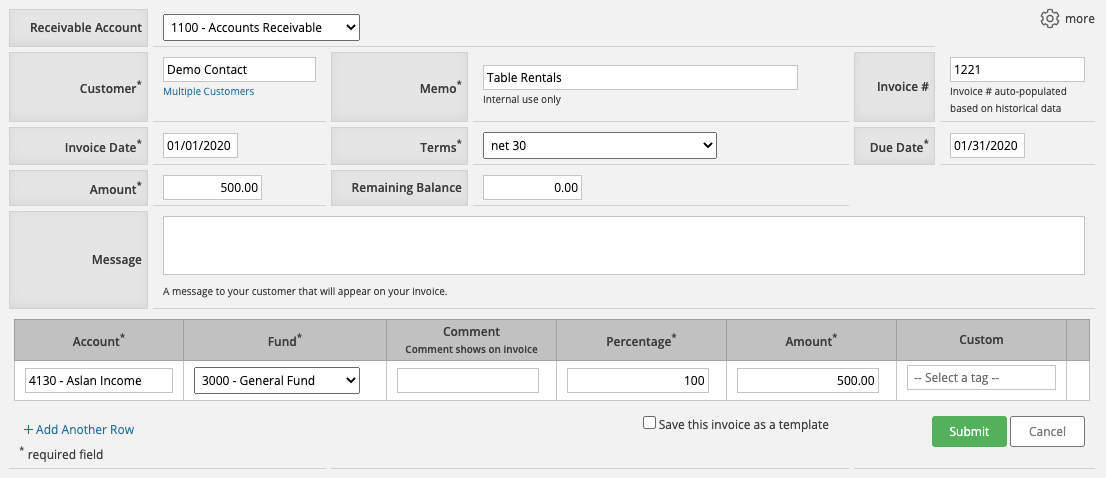

Entering Accounts Receivable

Accounts Receivable is used to enter money that is owed to you, but you haven’t received yet. As an example, say you have a preschool where you collect tuition from students. They owe $6,000 a year in tuition but pay $500 per month. You can record the receivable for the student for the total of $6,000, then record the monthly payments, which will decrease its balance each month.

For more information about entering accounts receivable, refer to our resource on Accounts Receivable.

For additional details on posting transactions in Aplos, feel free to check out this short webinar:

Reconciling Your Transactions

Once you have recorded your transactions, you can now reconcile them to your bank statement. Bank Reconciliation is the process that you complete to ensure that the information in your accounting software is accurate to your bank account.

First, print or download your bank statement.

When completing your first reconciliation, your opening balance will be zero because you haven’t done a bank reconciliation in Aplos yet. Any starting balance entered when you started using Aplos will be listed in your unreconciled transaction list. You will want to check this off in your reconciliation to reconcile. Going forward, the ending balance for your current bank reconciliation will become the opening balance of your next reconciliation.

Check out this resource on bank reconciliation for a step-by-step process, or watch a short webinar on the process.