Non-Cash, or In-Kind donations are a type of donation in which, instead of giving money to buy needed goods and services, the goods and services themselves are given.

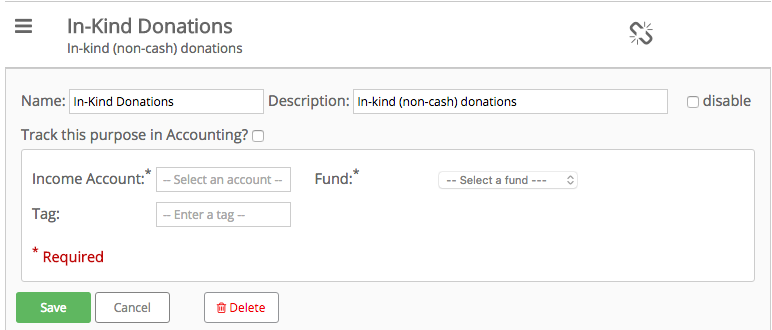

You can use Purposes to record non-cash donations so that a donation record is created and will show on a contribution statement, but not affect your Accounting. To do this, you’ll go to your Purposes page under Donations on the left side navigation. Create a new Purpose (or multiple Purposes if you’d like) by clicking on the “Create New” button and uncheck the “track this purpose in Accounting” box so that it’s not linked to Accounting.

Once created, you’ll have a couple of ways to record these donations:

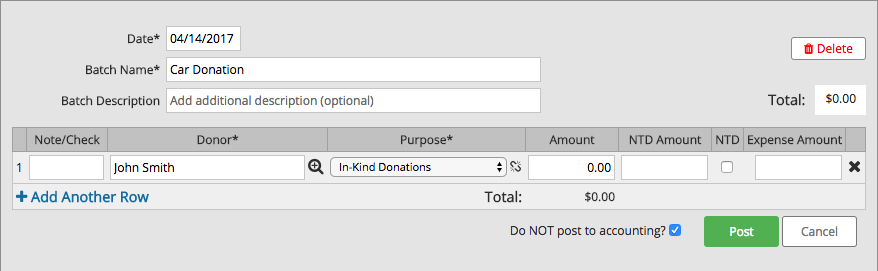

Option 1:

Go to Donations > Deposits to record multiple non-cash donations as a Deposit. You’ll use the newly created purpose(s) and check the box for “Do NOT post to Accounting”. This way the donation is recorded but it doesn’t affect your accounting.

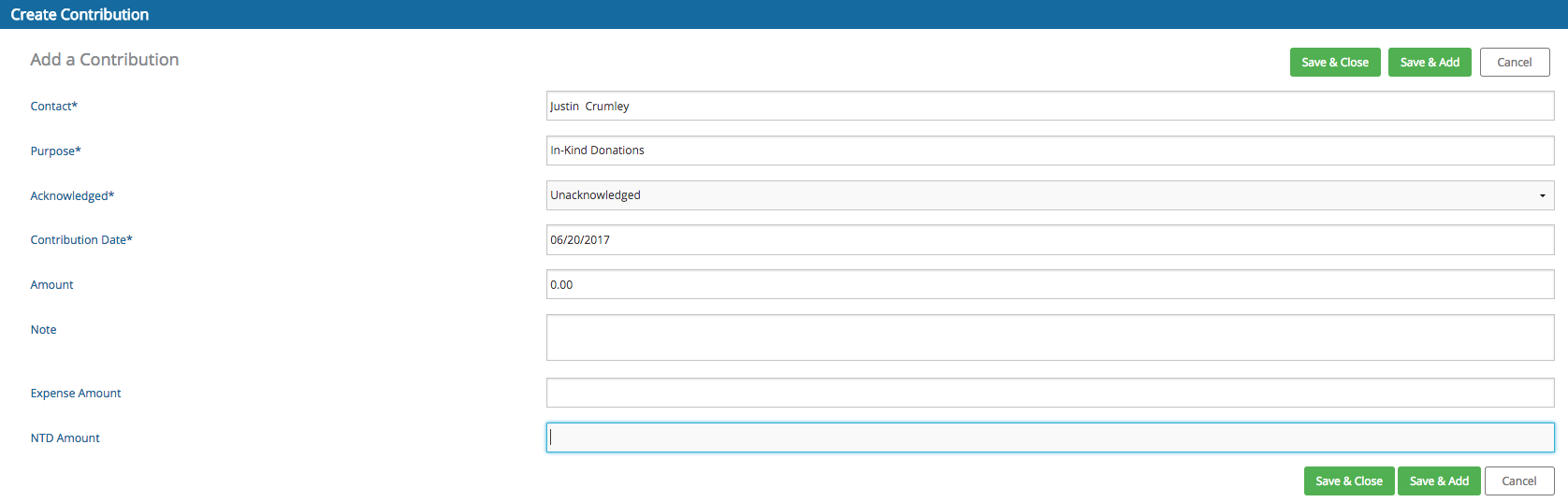

Option 2:

Go to Donations > Contributions to record a single non-cash donation. From this screen, you will want to click on “Add Contribution,” which will open a new form for you to select your contact, apply the donation details, and lastly select one of the “Save” options;

If you’d like, you can enter the amount as $0.00 in this field. This is because you may want to leave it up to the donor to decide just how much they would like to deduct from their taxes. Some organizations may operate differently in this regard and insert a fair value as of the date received. If you have more questions about what amount you should enter, you may need to consult an accountant.

This process will allow you to record the donation to give your donor credit for the item when generating contribution statements. You can reference the following guides to see how to generate individual contribution statements or generate contribution statements in bulk.