If you receive money from your church for living expenses in some way, shape or form, this reimbursement is called a housing allowance. Gusto goes more into detail regarding the nature of housing allowances here, and Aplos’ blog goes into how housing allowances are taxed here. If you would like to learn how to properly enter it into Gusto, continue reading.

Here’s how you can set this reimbursement up:

In Gusto, click on People from the lefthand menu. This will bring you to the list of employees in your organization so that you can click on the employee that you would like to add a housing allowance for. From the Job & Pay tab, scroll to the bottom and click Add Recurring Reimbursement.

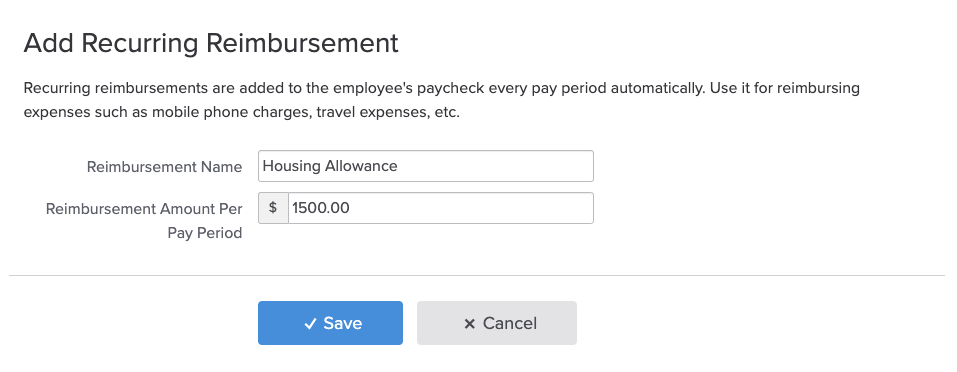

From here, you will name the reimbursement “Housing Allowance” and enter the amount that the employee receives per pay period.

**PLEASE NOTE:

Gusto does not currently enter the total amount received for housing allowance in Box 14 of the employee’s W2. It is required that you call Gusto at the end of your year to let them know any employees who received a housing allowance so that they can be sure that they adjust the W2 appropriately. If this is not done, the amount that they received for housing allowance will be included in the Wages, Tips, Other Compensation field of their W2.