As a nonprofit organization, you may be exempt from certain taxes, such as Federal Unemployment Tax Act (FUTA). Before setting up this exemption in Gusto, please refer to this article for the IRS to confirm your exemption.

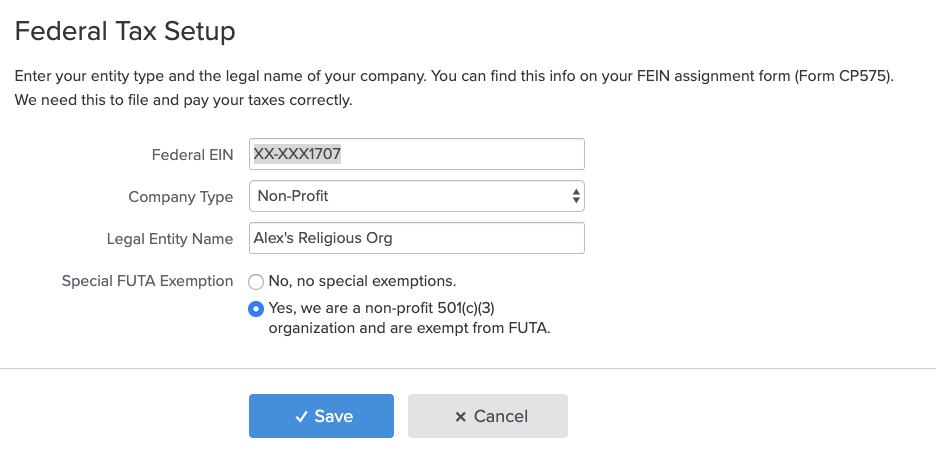

Once you confirm that you are, in fact, exempt from paying FUTA, you will need to specify this in your Gusto setup. This will be on Step 3 of your setup where you’ll complete federal tax info. Scroll to the section titled Federal Tax Setup. Here you’ll enter your Federal EIN, select Non-Profit for your Company Type, enter your organization’s legal name, and click the option that says “Yes, we are a non-profit 501(c)(3) organization and are exempt from FUTA.

Completing this process will prevent FUTA from being factored into your payruns.