When it comes to mapping your expenses and liability accounts used for payroll, many people have questions about which accounts are needed.

To start, go to the ‘Fund Accounting’ section, then click ‘Payroll’. Afterward, click on the gear icon on the righthand side. This will bring up the Global Mapping for those journal entries related to your payroll.

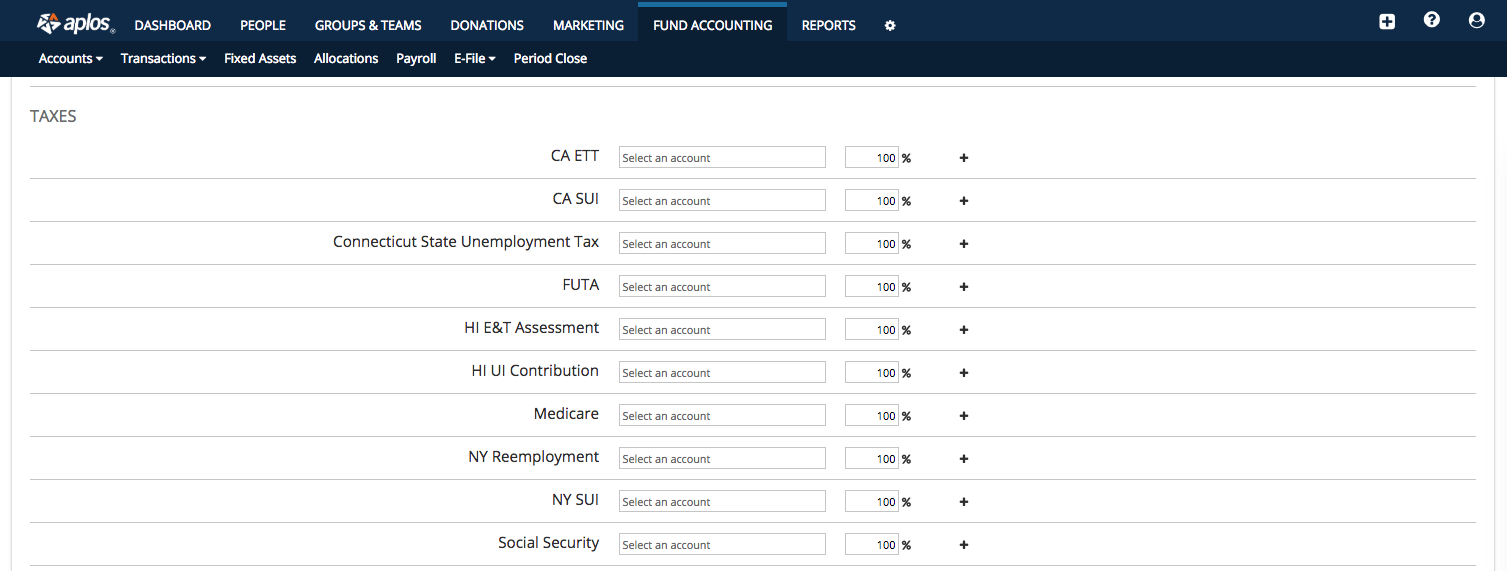

The categories shown on this screen will look like the screenshot below. The list will only be the applicable liability and expense categories needing to be mapped, based on your payroll runs from Gusto. For instance if you do not have a 403b benefit, you will not be required to map this in Aplos.

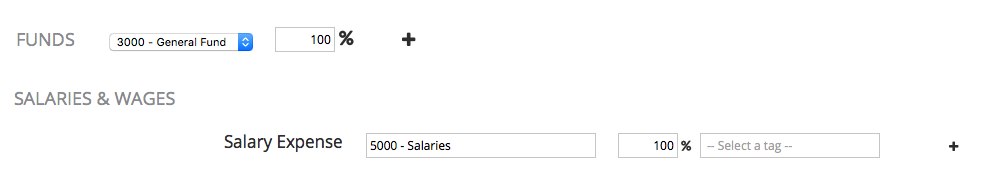

It’s important to keep in mind that this global mapping affects all employees. You cannot exempt an individual from certain accounts on this page. That will come later on. All you will be trying to accomplish on this page is deciding which accounts will relate to your employees generally. For example, for your Salary account, you might use your general Salaries Expense account.

Then, if you need your Pastor or Admin to have their salary recorded to their own salary expense account, you’ll designate that in the employee’s individual mapping. You can see how to specify certain accounts for your employees by following this article.

Once you are finished mapping the categories to the applicable Aplos account, click Save. You can edit this global mapping at any time, but keep in mind that any changes to the mapping will only affect future payroll imports.