Create A Payable

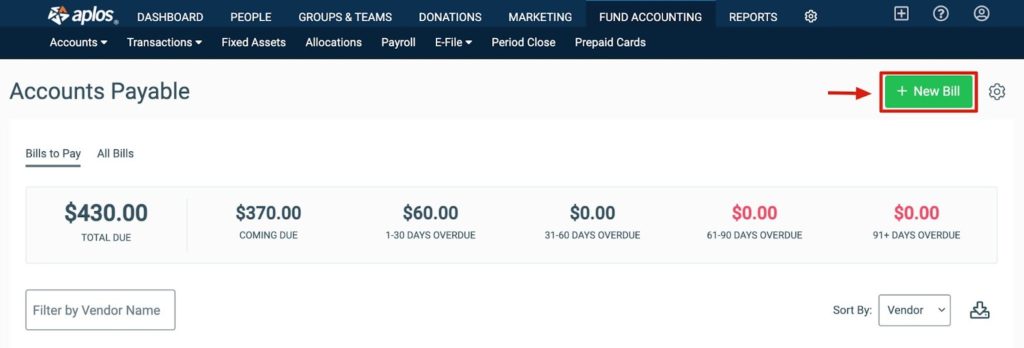

The Accounts Payable screen for transactions is where you can start recording new bills as you receive them. You’ll be able to fill in the details of the bill and assign the expense account(s) that will be used once the bill is paid. To begin, click “+ New Bill” to prompt an overlay page.

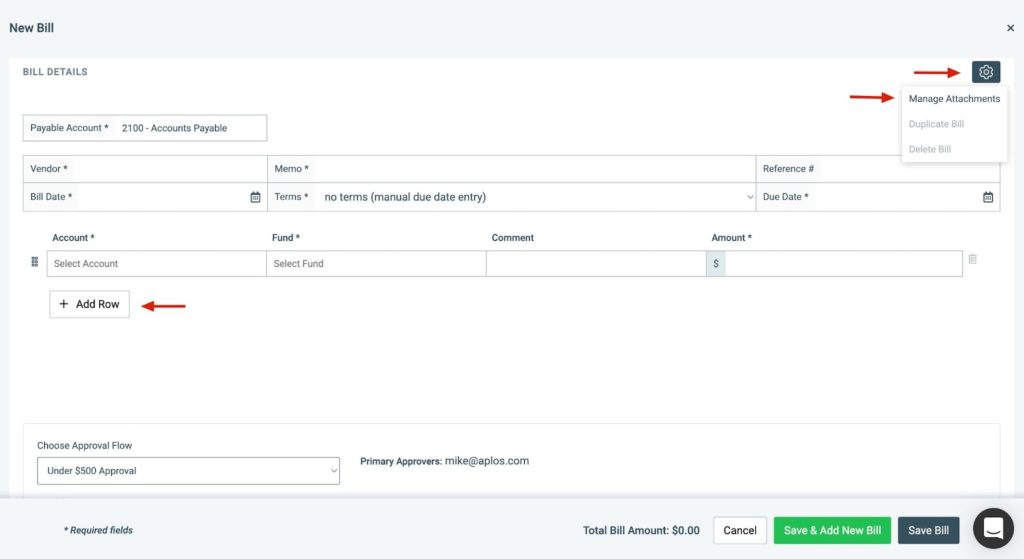

From the New Bill page, you can enter details regarding the bill. If you need to split the bill across multiple expense accounts and/or funds, select “+ Add Row” to generate a new line item. Enter the amount for each line item, and a total bill amount will be generated at the footer of the page.

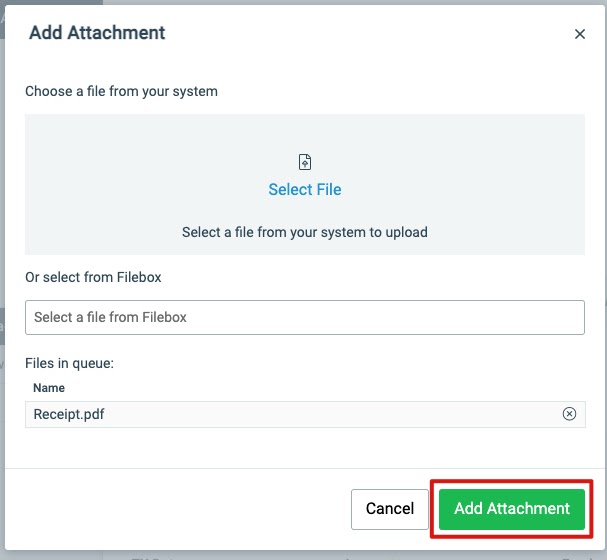

You can upload an attachment when creating the payable. Click the gear icon, and select “Manage Attachments.” You can upload a file from your computer or select an existing file within your Filebox.

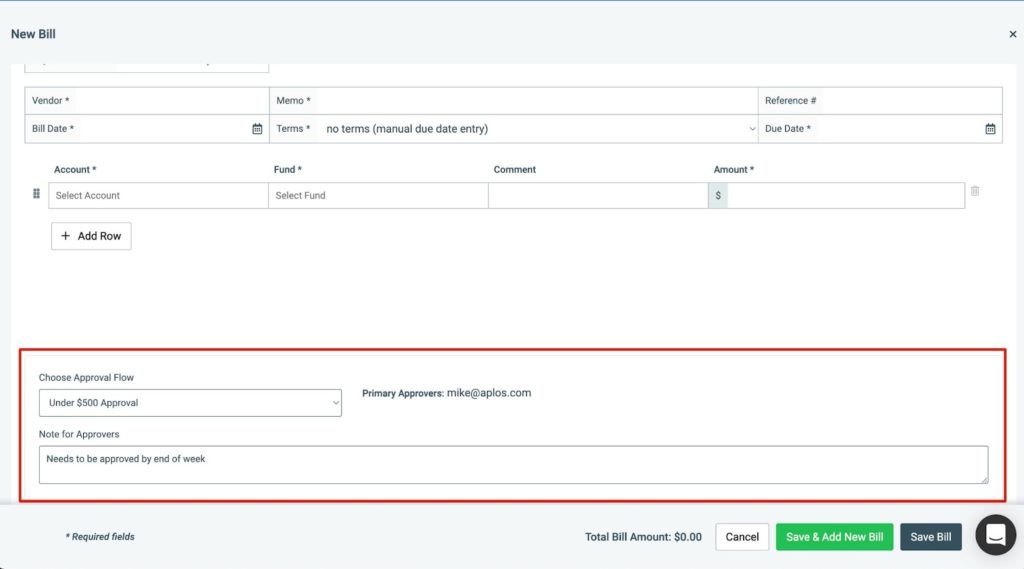

Assigning An Approval Workflow

If you have Bill Pay enabled, you can assign an Approval Flow to the bill and provide any necessary comments for the approvers.

View our Approval Flow guide to learn how to create Approval Flows.

Once all the correct details are entered, click “Save Bill” to save and navigate back to the Accounts Payable screen. You can also click “Save & Add New Bill” to save your current bill and start a new bill.

*NOTE: If Bill Pay is enabled, you can locate the newly created bill under the Pending Bills tab

Attachment Requirements

Once the attachment has been uploaded or selected, it will be displayed under “Files in queue.” Click “Add Attachment” to attach the file to the preferred payable.

File Requirements:

- Only .jpeg, .jpg, .png, .xlsx, .csv, and .pdf files will be accepted.

- Files must not exceed 100 MB.

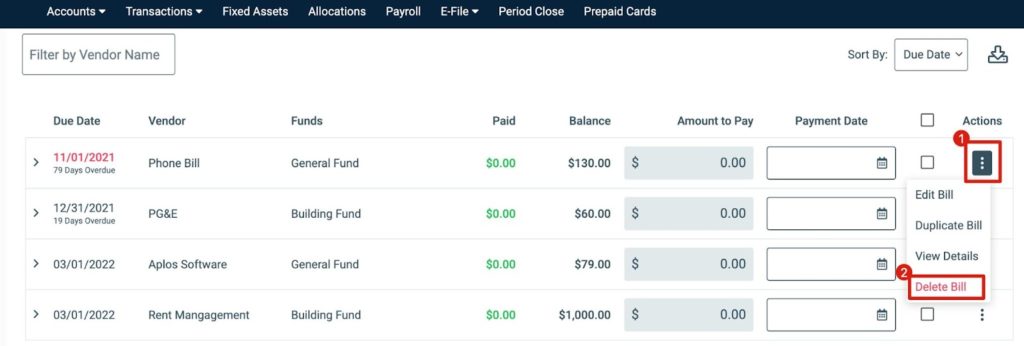

Deleting A Payable

If you have created a payable in error, or if you have decided to track your expense differently, you can delete it. Click on the Actions menu next to the preferred payable from the Bills to Pay screen and click “Delete Bill.” If you have recorded any payments on this payable, you will need to delete those in the register first. Once all payments on the payable have been deleted, the “Delete Bill” action will be available.